Bolivia: GDP Slows amid Strong Manufacturing and Faltering Hydrocarbons

November 1, 2011 - CEPR(Center for Economic and Policy Research)

By Rebecca Ray

Gross fixed capital formation has risen at a 9.7 percent annual rate so far in 2011.

Bolivia's GDP slowed to a 2.4 percent annualized growth rate (seasonally adjusted, quarter-over-quarter) in the second quarter, but it still saw robust growth in a few sectors: logistics, manufacturing, and public administration. From an expenditure perspective, most of the quarter's growth was due to rising gross fixed capital formation, which has risen at nearly a 10 percent annual rate so far in 2011. Both exports and imports contributed negatively to overall growth, although the trade surplus remained essentially unchanged.

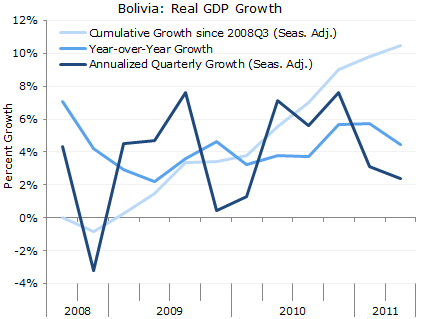

Overall Growth

Bolivian GDP grew at a 2.4 percent annual rate in the second quarter, down from 3.1 percent during the previous three months. Year-over-year growth fell from 5.7 to 4.4 percent. The economy is now 10.5 percent larger than its previous peak in the third quarter of 2008.

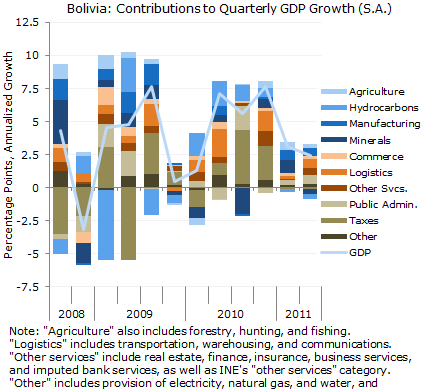

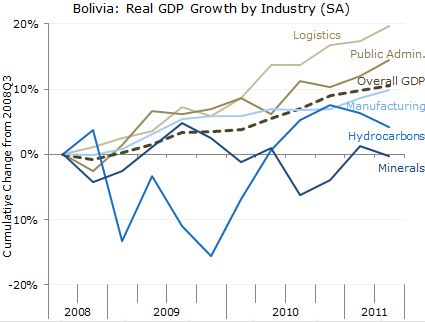

Growth by Industry

Growth was split fairly evenly among industries, with no sector accounting for more than one-third of overall GDP growth. However, manufacturing, logistics (which includes transportation, warehousing, and communications), and public administration were the most important, contributing 0.6, 0.6 and 0.7 percentage points respectively to overall, annualized quarterly growth. Together, these sectors accounted for over three-quarters of the economy's growth in the second quarter.

Only hydrocarbons and minerals shrank in the second quarter, shaving 0.7 percentage points of growth from the economy between them. This is the second consecutive quarter of negative real growth for hydrocarbons, which have fallen at a 6.2 percent annual rate so far in 2011. Meanwhile, minerals have had the worst performance of any industry since the economy peaked in late 2008. Their second-quarter decline actually lowered their real output to below their 2008 level, as the figure below shows.

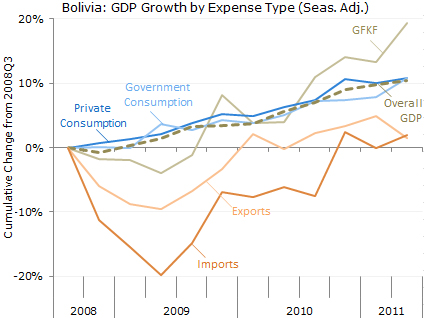

Growth by Expenditure Category

From an expenditure standpoint, growth was driven primarily by gross fixed capital formation (GFKF), which contributed 5.5 percentage points of annualized growth to the economy. This second-quarter surge in investment comes after negative growth in the first quarter. Still, it has grown at a 9.7 percent annual rate so far in 2011. As the figure below shows, its growth over the last year (13.8 percent) has dwarfed the growth of consumption and of overall GDP.

Private consumption also rose in the second quarter, but just enough to counteract its first-quarter decline. So far this year it has grown at just a 0.1 percent annual rate. Government consumption, which trailed behind overall GDP growth in late 2010 and early 2011, caught up in the second quarter, rising to 10.9 percent above its 2008 level. It grew at a 6.7 percent annual rate in the first half of 2011 and 5.9 percent over the last year.

Exports fell in the second quarter, at a 12.1 percent annual rate, while imports rose at a 7.9 percent annual rate. Each of these is a reversal from first-quarter performance, so for the first half of year exports have fallen at only a 3.4 percent annual rate, and imports have actually fallen as well, at a 1.0 percent annual rate. The drop in exports in the second quarter is not surprising, given slower GDP growth in Bolivia's main trading partner, Brazil. Exports fell back to only 1.6 percent above their 2008 level, and shaved 6.0 percentage points off of annualized quarterly growth. Meanwhile, rising imports took off an additional 3.6 percentage points of growth.

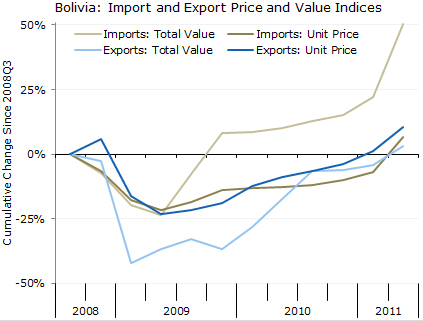

However, in nominal terms and measured as a share of GDP, both exports and imports rose just slightly: from 39.9 to 40.2, and from 33.8 to 34.2 percent of GDP, respectively. The result is that the trade balance stayed essentially flat, inching down from 6.1 to 6.0 percent of GDP. This large difference between the real growth for trade, discussed above, and the nominal shares of GDP is partly due to the changing terms of trade, shown in the figure below.

Looking to future releases, it will be important to watch export levels. These have fallen almost all the way back to their 2008 levels in real terms. This is not surprising given the slowing growth of Bolivia's main trading partner (Brazil), but it is nonetheless a negative sign for the economy. Also, private consumption barely kept above zero growth in the first half of 2011; whether it rises more solidly in the third quarter could be important to Bolivia's continued expansion. Nonetheless, it is a positive sign that second quarter growth was driven by manufacturing and logistics, as well as investment.

------------

Source: INE (Instituto Nacional de Estadística)

Latin America Data Bytes are brief, timely analyses of official data releases from governments and multilateral organizations. Published approximately three times every month, the Bytes cover topics such as GDP, inflation, employment, and other key indicators of economic development.